Page 23 - 2022 Annual Report

P. 23

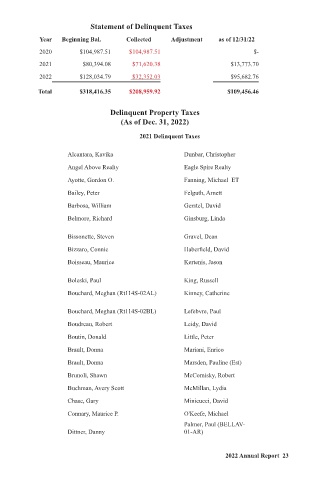

Statement of Delinquent Taxes

Year Beginning Bal. Collected Adjustment as of 12/31/22

2020 $104,987.51 $104,987.51 $-

2021 $80,394.08 $71,620.38 $13,773.70

2022 $128,034.79 $32,352.03 $95,682.76

Total $318,416.35 $208,959.92 $109,456.46

Delinquent Property Taxes

(As of Dec. 31, 2022)

2021 Delinquent Taxes

Alcantara, Kavika Dunbar, Christopher

Angel Above Realty Eagle Spire Realty

Ayotte, Gordon O. Fanning, Michael ET

Bailey, Peter Felguth, Arnett

Barbosa, William Gerstel, David

Belmore, Richard Ginsburg, Linda

Bissonette, Steven Gravel, Dean

Bizzaro, Connie Haberfield, David

Boisseau, Maurice Kertenis, Jason

Boleski, Paul King, Russell

Bouchard, Meghan (Rt114S-02AL) Kinney, Catherine

Bouchard, Meghan (Rt114S-02BL) Lefebvre, Paul

Boudreau, Robert Leidy, David

Boutin, Donald Little, Peter

Brault, Donna Mariani, Enrico

Brault, Donna Marsden, Pauline (Est)

Brunoli, Shawn McComisky, Robert

Buchman, Avery Scott McMillan, Lydia

Chase, Gary Minicucci, David

Connary, Maurice P. O'Keefe, Michael

Palmer, Paul (BELLAV-

Dittner, Danny 01-AR)

2022 Annual Report 23