Page 22 - 2022 Annual Report

P. 22

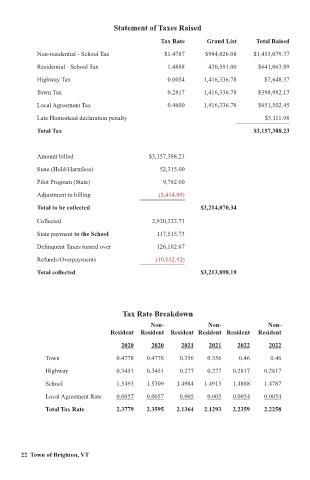

Statement of Taxes Raised

Tax Rate Grand List Total Raised

Non-residential - School Tax $1.4787 $984,026.08 $1,455,079.37

Residential - School Tax 1.4888 430,591.00 $641,063.89

Highway Tax 0.0054 1,416,336.78 $7,648.37

Town Tax 0.2817 1,416,336.78 $398,982.17

Local Agreement Tax 0.4600 1,416,336.78 $651,502.45

Late Homestead declaration penalty $3,111.98

Total Tax $3,157,388.23

Amount billed $3,157,388.23

State (Hold-Harmless) 52,315.00

Pilot Program (State) 9,782.00

Adjustment to billing (5,414.89)

Total to be collected $3,214,070.34

Collected 2,920,232.71

State payment to the School 117,515.73

Delinquent Taxes turned over 126,182.67

Refunds/Overpayments (10,032.92)

Total collected $3,213,898.19

Tax Rate Breakdown

Non- Non- Non-

Resident Resident Resident Resident Resident Resident

2020 2020 2021 2021 2022 2022

Town 0.4778 0.4778 0.356 0.356 0.46 0.46

Highway 0.3451 0.3451 0.277 0.277 0.2817 0.2817

School 1.5493 1.5309 1.4984 1.4913 1.4888 1.4787

Local Agreement Rate 0.0057 0.0057 0.005 0.005 0.0054 0.0054

Total Tax Rate 2.3779 2.3595 2.1364 2.1293 2.2359 2.2258

22 Town of Brighton, VT