Page 21 - 2022 Annual Report

P. 21

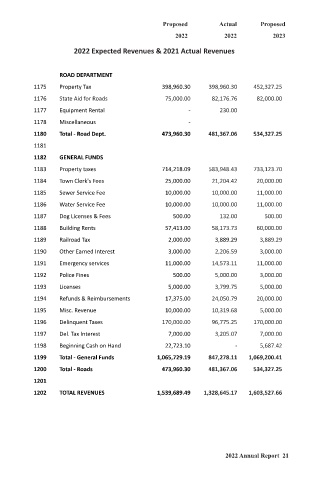

Proposed Actual Proposed

2022 2022 2023

2022 Expected Revenues & 2021 Actual Revenues

ROAD DEPARTMENT

1175 Property Tax 398,960.30 398,960.30 452,327.25

1176 State Aid for Roads 75,000.00 82,176.76 82,000.00

1177 Equipment Rental - 230.00

1178 Miscellaneous -

1180 Total - Road Dept. 473,960.30 481,367.06 534,327.25

1181

1182 GENERAL FUNDS

1183 Property taxes 714,218.09 583,948.43 733,123.70

1184 Town Clerk's Fees 25,000.00 21,204.42 20,000.00

1185 Sewer Service Fee 10,000.00 10,000.00 11,000.00

1186 Water Service Fee 10,000.00 10,000.00 11,000.00

1187 Dog Licenses & Fees 500.00 132.00 500.00

1188 Building Rents 57,413.00 58,173.73 60,000.00

1189 Railroad Tax 2,000.00 3,889.29 3,889.29

1190 Other Earned Interest 3,000.00 2,206.59 3,000.00

1191 Emergency services 11,000.00 14,573.11 11,000.00

1192 Police Fines 500.00 5,000.00 3,000.00

1193 Licenses 5,000.00 3,799.75 5,000.00

1194 Refunds & Reimbursements 17,375.00 24,050.79 20,000.00

1195 Misc. Revenue 10,000.00 10,319.68 5,000.00

1196 Delinquent Taxes 170,000.00 96,775.25 170,000.00

1197 Del. Tax Interest 7,000.00 3,205.07 7,000.00

1198 Beginning Cash on Hand 22,723.10 - 5,687.42

1199 Total - General Funds 1,065,729.19 847,278.11 1,069,200.41

1200 Total - Roads 473,960.30 481,367.06 534,327.25

1201

1202 TOTAL REVENUES 1,539,689.49 1,328,645.17 1,603,527.66

2022 Annual Report 21