Page 22 - 2021 Annual Reportprint

P. 22

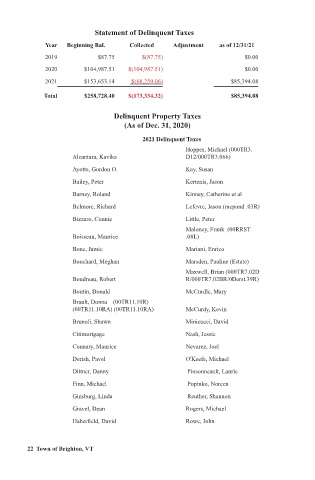

Statement of Delinquent Taxes

Year Beginning Bal. Collected Adjustment as of 12/31/21

2019 $87.75 $(87.75) $0.00

2020 $104,987.51 $(104,987.51) $0.00

2021 $153,653.14 $(68,259.06) $85,394.08

Total $258,728.40 $(173,334.32) $85,394.08

Delinquent Property Taxes

(As of Dec. 31, 2020)

2021 Delinquent Taxes

Hoppes, Michael (000TR3.

Alcantara, Kavika D12/000TR3.066)

Ayotte, Gordon O. Kay, Susan

Bailey, Peter Kertenis, Jason

Barney, Roland Kinney, Catherine et al

Belmore, Richard Lefevre, Jason (mcpond .03R)

Bizzaro, Connie Little, Peter

Maloney, Frank (00RRST

Boisseau, Maurice .08L)

Bone, Jamie Mariani, Enrico

Bouchard, Meghan Marsden, Pauline (Estate)

Maxwell, Brian (000TR7.02D

Boudreau, Robert R/000TR7.02BR/0Derst.39R)

Boutin, Donald McCurdle, Mary

Brault, Donna (00TR11.10R)

(00TR11.10RA) (00TR11.10RA) McCurdy, Kevin

Brunoli, Shawn Minicucci, David

Citimortgage Nash, Jessie

Connary, Maurice Nevarez, Joel

Derish, Pavel O'Keefe, Michael

Dittner, Danny Pinsonneault, Laurie

Finn, Michael Popinko, Noreen

Ginsburg, Linda Reuther, Shannon

Gravel, Dean Rogers, Michael

Haberfield, David Rowe, John

22 Town of Brighton, VT