Page 19 - Town of Brighton Annual Report 2023

P. 19

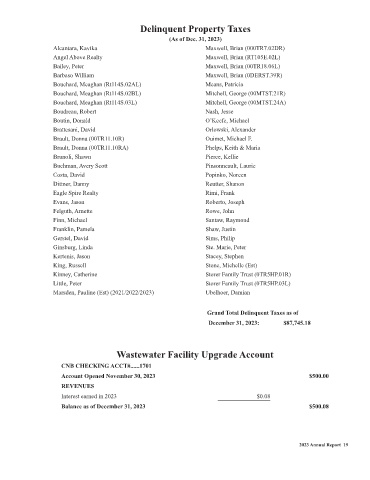

Delinquent Property Taxes

(As of Dec. 31, 2023)

Alcantara, Kavika Maxwell, Brian (000TR7.02DR)

Angel Above Realty Maxwell, Brian (RT105E.02L)

Bailey, Peter Maxwell, Brian (00TR18.06L)

Barbaso William Maxwell, Brian (0DERST.39R)

Bouchard, Meaghan (Rt114S.02AL) Means, Patricia

Bouchard, Meaghan (Rt114S.02BL) Mitchell, George (00MTST.21R)

Bouchard, Meaghan (Rt114S.03L) Mitchell, George (00MTST.24A)

Boudreau, Robert Nash, Jesse

Boutin, Donald O’Keefe, Michael

Brattesani, David Orlowski, Alexander

Brault, Donna (00TR11.10R) Ouimet, Michael F.

Brault, Donna (00TR11.10RA) Phelps, Keith & Maria

Brunoli, Shawn Pierce, Kellie

Buchman, Avery Scott Pinsonneault, Laurie

Costa, David Popinko, Noreen

Dittner, Danny Reutter, Shanon

Eagle Spire Realty Rimi, Frank

Evans, Jason Roberto, Joseph

Felguth, Arnette Rowe, John

Finn, Michael Santaw, Raymond

Franklin, Pamela Shaw, Justin

Gerstel, David Sims, Philip

Ginsburg, Linda Ste. Marie, Peter

Kertenis, Jason Stacey, Stephen

King, Russell Stone, Michelle (Est)

Kinney, Catherine Storer Family Trust (0TR5HP.01R)

Little, Peter Storer Family Trust (0TR5HP.03L)

Marsden, Pauline (Est) (2021/2022/2023) Ubelhoer, Damian

Grand Total Delinquent Taxes as of

December 31, 2023: $87,745.18

Wastewater Facility Upgrade Account

CNB CHECKING ACCT#......1701

Account Opened November 30, 2023 $500.00

REVENUES

Interest earned in 2023 $0.08

Balance as of December 31, 2023 $500.08

2023 Annual Report 19