Page 18 - Town of Brighton Annual Report 2023

P. 18

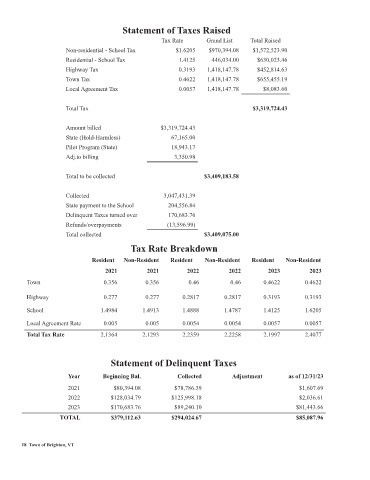

Statement of Taxes Raised

Tax Rate Grand List Total Raised

Non-residential - School Tax $1.6205 $970,394.08 $1,572,523.90

Residential - School Tax 1.4125 446,034.00 $630,023.46

Highway Tax 0.3193 1,418,147.78 $452,814.63

Town Tax 0.4622 1,418,147.78 $655,455.19

Local Agreement Tax 0.0057 1,418,147.78 $8,083.60

Total Tax $3,319,724.43

Amount billed $3,319,724.43

State (Hold-Harmless) 67,165.00

Pilot Program (State) 18,943.17

Adj.to billing 3,350.98

Total to be collected $3,409,183.58

Collected 3,047,431.39

State payment to the School 204,556.84

Delinquent Taxes turned over 170,683.76

Refunds/overpayments (13,596.99)

Total collected $3,409,075.00

Tax Rate Breakdown

Resident Non-Resident Resident Non-Resident Resident Non-Resident

2021 2021 2022 2022 2023 2023

Town 0.356 0.356 0.46 0.46 0.4622 0.4622

Highway 0.277 0.277 0.2817 0.2817 0.3193 0.3193

School 1.4984 1.4913 1.4888 1.4787 1.4125 1.6205

Local Agreement Rate 0.005 0.005 0.0054 0.0054 0.0057 0.0057

Total Tax Rate 2.1364 2.1293 2.2359 2.2258 2.1997 2.4077

Statement of Delinquent Taxes

Year Beginning Bal. Collected Adjustment as of 12/31/23

2021 $80,394.08 $78,786.39 $1,607.69

2022 $128,034.79 $125,998.18 $2,036.61

2023 $170,683.76 $89,240.10 $81,443.66

TOTAL $379,112.63 $294,024.67 $85,087.96

18 Town of Brighton, VT